Avatrade India Review

Bonus

Avatrade does not offer any bonuses

- Organization AVA Trade Ltd

- Payout option -

- Minimum Deposit 10$

- Demo account Yes

- Indian Yes

- Compatibility Android, Mac OS, Windows, iOS

- Platform type Self - Developed

- Minimum investment value $1

Contents

AvaTrade is a leading global Forex trading platform founded in 2006. Ava is a multi-national company with sales centers and regional offices in Paris, Milan, Dublin, Tokyo, and Sydney.

The company has an administrative headquarters in Dublin, Ireland. Avatrade has a lengthy track of records as it is among the first brokerages in retail Forex.

With seven regulations across six continents, AvaTrade is among the most secure platforms in the industry. Avatrade’s regulators include the Australian Securities and Investments Commission (ASIC) and the B.V. Financial Services Commission.

This broker is the first to receive a 3A license from Abu Dhabi Global Markets (ADGM), allowing the platform to offer professional and retail trading services.

Since its establishment, AvaTrade has made significant progress, with more than 300,000 registered customers executing over 2 million trades per month. Avatrade has been monitored and honoured for remarkable technological and financial achievements.

The broker has 36 awards, and every award it receives proves success in identifying and meeting traders’ expectations. The broker combines user perspective with solid financial backing, a unique feature in the trading field.

India is among the countries where Avatrade is legal. Whether you are a seasoned Indian trader or a novice, the Avatrade platform is adaptable, and its services aim for a perfect balance of sophistication and simplicity.

This review entails the key services and features of this award-winning broker. Let us find out what it is like to trade here.AvaTradee Trading Platform – Trading Offers (Assets)

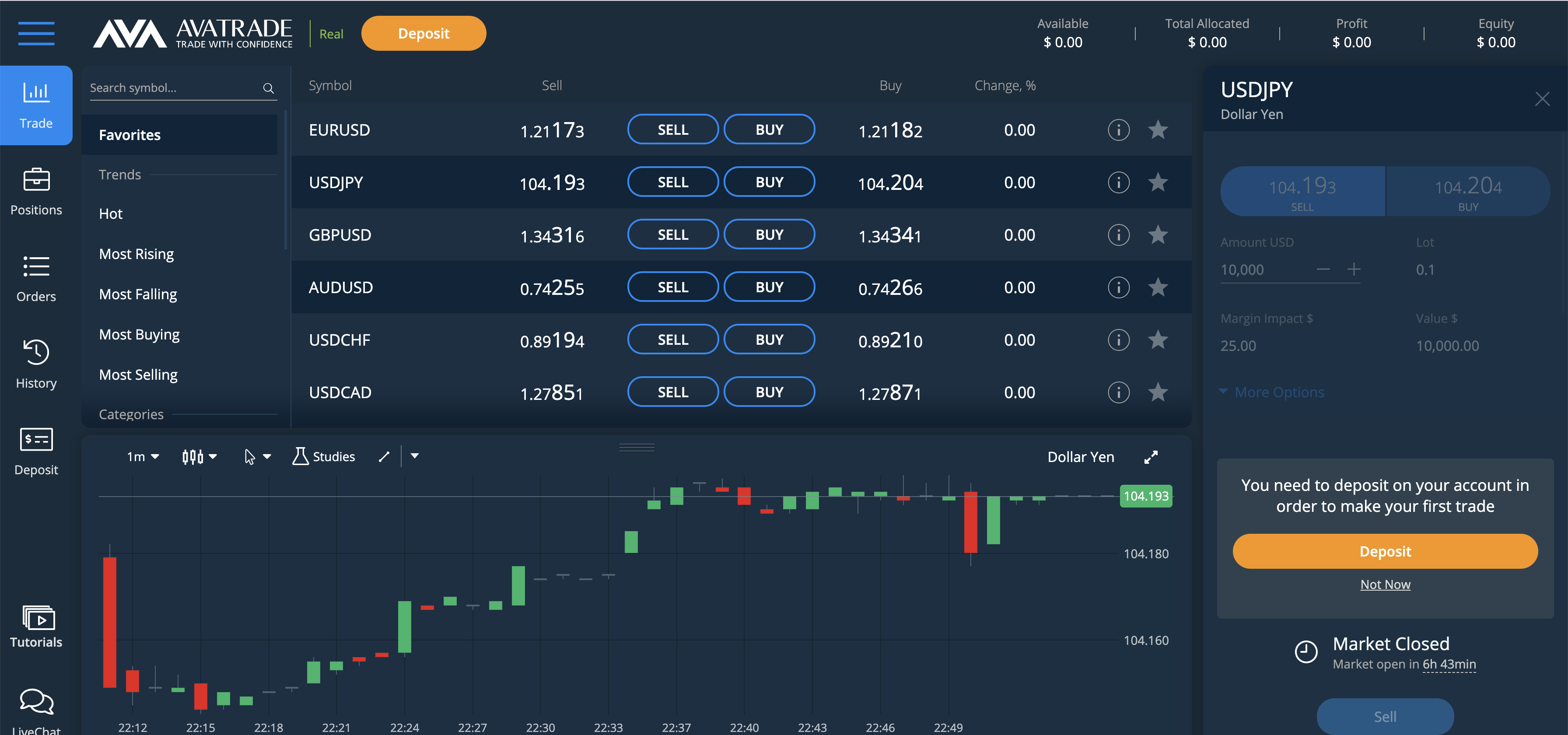

Indian traders will find a decent range of underlying assets at AvaTrade. There is a total of more than 1000 products to trade on.

They are divided into different classes, including over 500 stocks, 55 currency pairs, 19 commodities, 20 indices, five major ETFs, two government bonds, and 14 Cryptocurrencies.

These products keep increasing to continue offering Indian traders the ultimate trading experience. Highlights and popular trades include currency pairs like USD/EUR and EUR/JPY, stocks like Apple, Amazon, Berkshire Hathaway, the VIX ETF, and Bitcoin.

You can invest in long trades where you own an asset until you dash out. Besides, you can trade on CFDs where you hold short-term positions for some minutes, days, and weeks.

Trading tools and analysis, economic calendars, and indicators are available to help you make informed decisions. Avatrade also has a social trading app where you can copy trades by the best investors, chat with them, and benefit from their success.

Avatrade India Account Types

There are four main trading accounts at AvaTrade. You can begin with a demo account to sharpen your skills before opening a live account.

The demo account is loaded with INR734500 practice money to help you execute trial trades, and you can request more cash in case you run out of money. Once you are confident with your skills and have made significant profits, you can open a live account.

Besides the demo account, you can open a standard Islamic account or a VIP account. An Avatrade standard account is easy to open and requires little investment of INR7300. Here, you will have a maximum leverage of 400:1 in major markets.

You can also open an Islamic account where you do not incur swap fees, per Sharia laws. Once registered, you can request this account and wait for the support department to approve your request. This process only takes 1-3 working days.

The VIP account requires a minimum deposit of INR734500. This account has incredible benefits such as low spreads, monthly analysis, account manager, and other returns.

AvaTrade Trading Account Commissions, Spreads and Trading Conditions

AvaTrade is transparent with its fees and costs. Here is what you should expect when trading with this broker.

Commissions

Like most brokers, AvaTrade does not charge any commission fees. It means you can execute your sell or buy orders without incurring fees. Instead, this is compensated through spreads.

Spreads

Spread is the difference between where you purchase and sell your asset. Spreads vary depending on different factors, including trade time, liquidity, and volatility.

During market hours, the competition tends to be stiffer. The more volatile a market is, the wider the spreads. However, there are fixed spreads at Avatrade unaffected by the above factors.

Overnight Funding

You also referred to as overnight premium is a fee charged on all positions held overnight. If you hold a position over the weekend, you will be charged a 3-day swap fee. The charges vary with assets and markets.

This information is not clear on the platform. If you want to learn about overnight funding in detail, go to “Trading Info” and check out the extensive overview of the calculations. The overnight funding fees apply in the CFDs trading.

Ava trade Forex Minimum Deposit and Withdrawals

Indian traders can deposit and withdraw money from their accounts with ease. You can choose from several currencies: USD, GBP, EUR, CHF, and AUD. Transactions are processed quickly in a safe and secure environment. Here are the available deposit and Withdrawal methods at AvaTrade.

Deposits

There is a decent range of deposit options. They include Mastercard, Visa, Neteller, Skrill, Paypal, Bank Wire Transfers, and WebMoney. The minimum deposit is INR7300, while there is no maximum deposit limit.

All deposits are instant; you can fund your account and start trading immediately. AvaTrade does not charge any deposit fees. You must log in to the personal client area to fund your account. Go to the menu button “Deposit Money” and specify your preferred currency, amount, and payment method.

Withdrawals

You can withdraw your profits through the same method you used to deposit. Withdrawal processing takes only one to two working days. The fastest option is the Avat Debit Mastercard, which you can apply once you open an account.

The minimum Withdrawal is INR7300, and no maximum withdrawal limit exists. AvaTrade does not charge withdrawal charges, but your service provider might charge you.

Trading Platforms

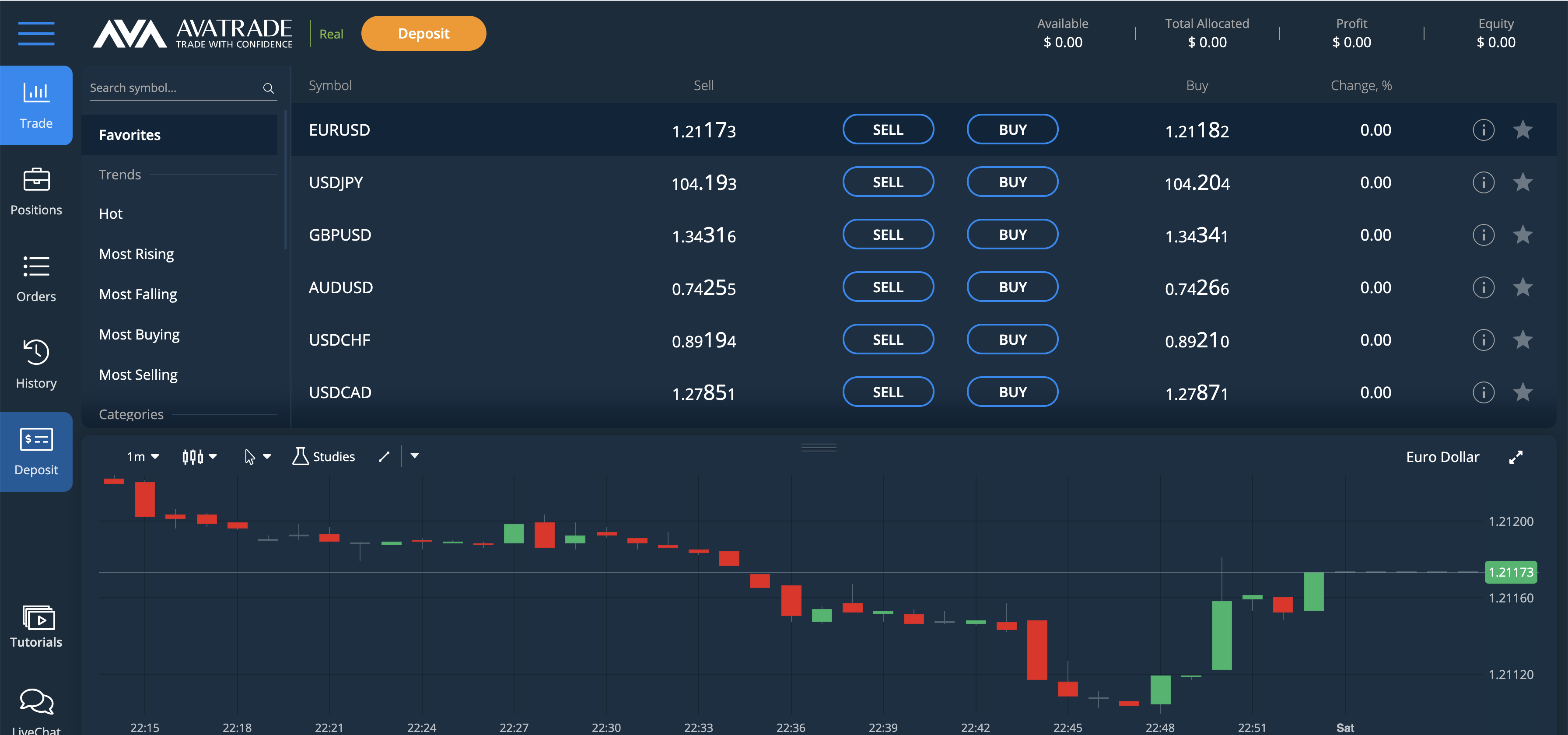

As a way of Avatrade’s commitment to empowering people to trade, the broker caters to all types of clients. The brokerage offers four main automated and manual trading platforms across various devices.

The main aim of Avatrade is to ensure that customers enjoy a seamless trading experience. In all platforms, you will find essential analytical tools, charts, and indicators to help you make informed decisions. Below are the available options.

Web Trading

It is an award-winning trading proprietary platform that does not require any download. The platform is intuitive, user-friendly, and a favourite for many Avatrade clients.

AvaTrade

AvaTrade is a trade-on-the-go app that is very easy to use. It boasts a friendly interface, advanced trading charts, and features that work perfectly on mobile.

Meta Trader 4

It is the most popular trading platform in the industry. Avatrade offers MT4 or MetaTrader 4, creating a very flexible and powerful suit for seasoned and novice players. It provides automated trading by selecting order types and expert advisors.

Meta Trader 5

This is the next generation of the Meta Trade platform. It offers state-of-the-art capabilities, including more specialized order types, analysis tools, graphical objects, and time frames.

The platform also provides automated trading plus MQL5 coding language. MQL5 allows you to access thousands of signals from international providers.

AvaTrade Mobile Trading and Management Tools

Mobile trading has become popular recently, and most people prefer trading on the go. As such, AvaTrade provides a downloadable mobile trading app, AvaTradeGO, which is easy to use and navigate. It offers a smooth trading experience.

AvaTradeGO has features that allow you to enjoy all the powerful features of MT4 and MT5. The app is compatible with Android and iOS devices and is available in Google Play and Apple Store,

It has an intuitive design with a sophisticated dashboard, making your trading experience more exciting.

You can access all the features, products, and services of Avatrade on mobile, including a demo account, social trading notifications, customer support, payments, pending orders and more. This app also allows traders to customize their dashboards based on their preferences. Regarding performance, this mobile app is fast as long as your internet connection is stable.

If you do not wish to download the app, use the Safari or Chrome-based version that requires you to log in to your account.

Bonuses and Promotions

Currently, Avatrade does have a welcome bonus for Indian players. However, there is a refer-a-friend offer that you could take advantage of to boost your bankroll. All you need to do is log in to your account and go to the “ Refer a Friend” section, where you get your link. You can now share the link with your friends.

To receive your bonus, the friend must create an account, make a minimum deposit of INR36700, and open at least ten trades. The minimum bonus is INR 3670, while the maximum is INR 18300, depending on the friends’ deposit.

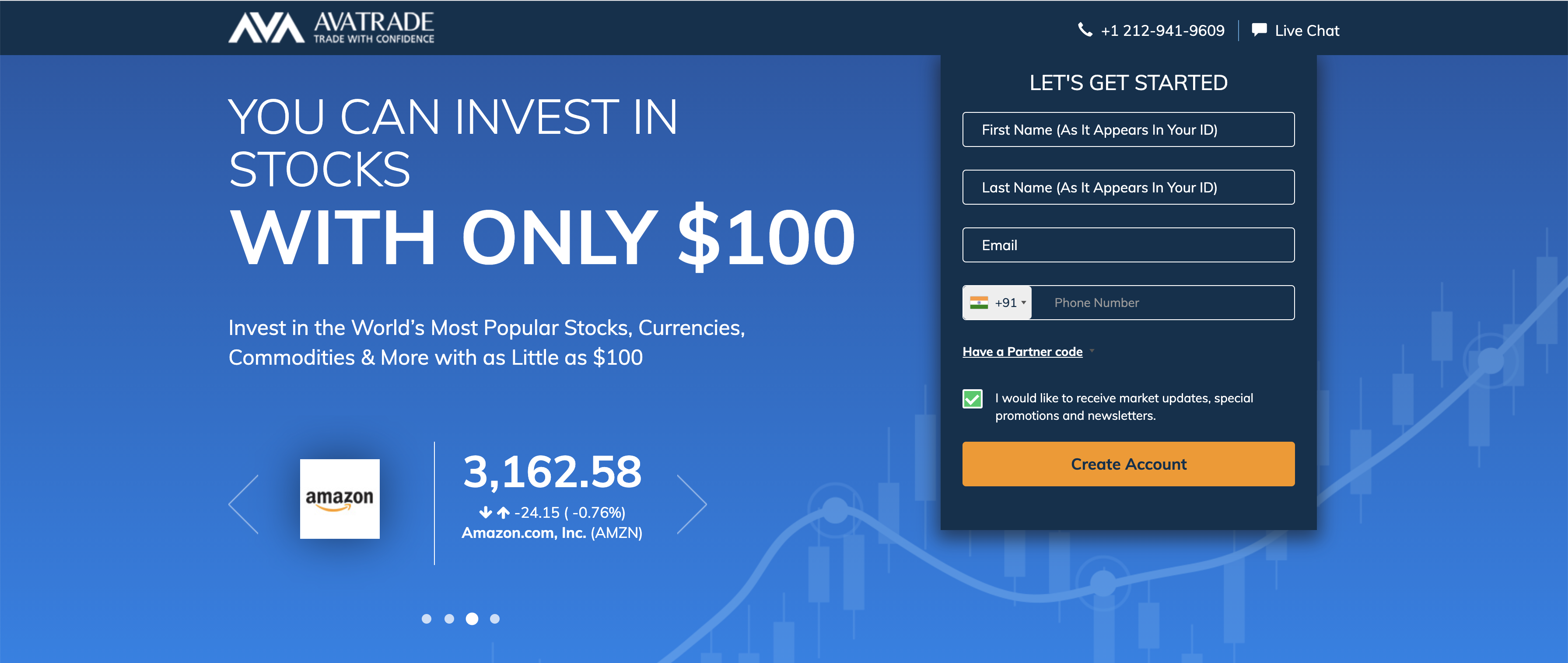

How do you open an account on Avatrade India?

To open an account with AvaTrade India, you will need to provide the following information:

- Your name, proof of address, I.D. card and contact details

- Your date of birth and nationality

- Your occupation and income

- Your trading experience

- Your investment goals

You will also need to make a minimum deposit of $100.

Assets Available

AvaTrade offers a wide range of assets to trade, including:

- Forex and CFD

- Stocks

- Indices

- Commodities

- Crypto

Customer Support

Avatrade offers a multi-lingual customer support service. You can reach them through live chat, email, and phone calls. There is also an extensive FAQ section with answers to common questions about Avatrade.

Here, you will find details on payments, account registration and verification, trading platforms, and more. You can go through the section before contacting the support team. If you do not find answers to your questions, feel free to ask for help. Live chat is the fastest way to contact the customer support team. You will receive immediate and informative responses to your queries.

You can also call their international helpline at +353766705834 if you wish to talk directly to someone. The AvaTrade customer support service is impressive.

Conclusion

AvaTrade is a reliable broker that we would highly recommend to Indian traders. The platform is regulated worldwide by seven authorities, meaning it is safe to trade.

There is a wide range of trading instruments, including stocks, ETFs, government bonds, currency pairs, Cryptocurrencies, commodities, and indices. Besides, AvaTrade offers enough trading platforms to cater to all traders.

If you love playing on the move, you will appreciate the AvaTradeGO app, with an intuitive design to keep you hooked. The customer support representatives are friendly and professional.

They are always available to respond to any personal or technical issues. If you are an Indian trader looking for a trustworthy broker, AvaTrade should be your next destination.

FAQ

-

Is Avatrade broker legal?Yes. Avatrade has 7 regulations across 6 continents. Among the regulators are the Australian Securities and Investments Commission (ASIC), B.V Financial Services Commission, and Abu Dhabi Global Markets (ADGM). It means that the site meets all the requirements of an online trading platform and that it adheres to the laws of the industry.

-

Is Avatrade a market maker?Avatrade is not a market maker but a broker.

-

Does Avatrade offer a demo account?Yes. Avatrade offers traders a demo account loaded with cash to sharpen their skills. You can take as long as you want until you are comfortable to open a live account.

-

What can I trade on at Avatrade?There are varieties of products to trade on at Avatrade. They are divided into different classes, including stocks, ETFs, government bonds, currency pairs, Cryptocurrencies, commodities, and indices. You can trade on CFDs or invest in long term positions where you own an asset until you decide to cash out.

-

What are CFDs?Contracts For Difference (CFDs) are financial derivative products, which allow users to trade on financial assets such as indices, currency pairs, commodities, ETFs, and Cryptocurrencies. With CFDs, you can freely trade 24/7 on price fluctuations without taking ownership of the underlying asset. The key benefit of CFDs is the flexibility of trading against price action without selling or buying the physical instrument.

-

Does Avatrade offer Meta Trader 4?Absolutely! Avatrade offers a Mets Trader 4 trading platform that offers automated trading by using a selection of order types and expert advisors.

-

How long does the withdrawal process take?The process takes 1-2 days for most withdrawal options. Withdrawals done through Bank Wire Transfer may take to 5 working days.

- Helpful Guide on How to Use Parimatch in India - September 6, 2023

- What is Matched Betting and What are its Advantages? An Ultimate Guide - July 19, 2023

- Top IPL Betting Apps - November 4, 2022